A Look at Recreational Marijuana’s Impact on Michigan’s Economy

Ever since adult-use/recreational marijuana was legalized in November 2018, the industry has been quickly catching up to the widespread demand. While adult-use cannabis has proved to be a lucrative up-and-coming industry in Michigan (in January, the Department of Licensing and Regulatory Affairs [LARA] announced that adult-use cannabis sales reached over $10 million), there are still obstacles to its growth.

This past March, the Marijuana Regulatory Agency (MRA) commissioned a study by Michigan State University Product Center Food-Ag-Bio to outline the market and potential economic impact of the adult-use marijuana industry in Michigan.

Below, we have outlined the most important takeaways from this report, as it relates to cannabis companies.

Retail Value of Marijuana

It is estimated that the retail value of marijuana sales will be in the range of $3 billion a year, with a total economic benefits in excess of $7.8 billion, once the market matures.

Barriers for the Cannabis Industry

There are two possible barriers to the growth of the industry:

- The lack of acceptance by local communities.

Currently, there are relatively few communities that allow recreational marijuana. More than 1,400 communities, including Detroit, have opted-out of recreational marijuana. Several others have been slow to adopt ordinances, as they are taking a “wait-and-see” approach.

- The lack of testing facilities and capacity.

“Marijuana needs to pass testing before it can be sold, and currently, it takes several weeks before growers and processors receive their results. The slow rate of local approval and the backlog of testing has created a bottleneck in the supply chain and are factors that partially explain why marijuana prices in Michigan remain quite high.”

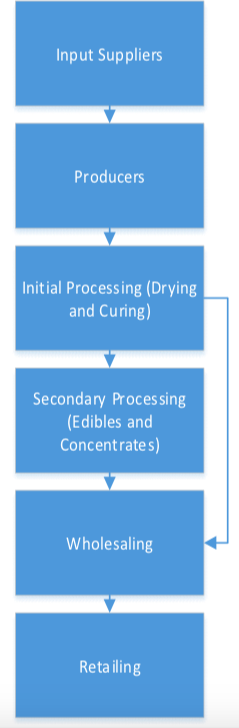

Supply Chain

According to the study, the supply chain for recreational marijuana appears to be maturing rapidly. This can be attributed to vertical integration, with some licensees growing marijuana as well as processing it.

Control of the supply chain is still being developed. Currently, it appears that the production and distribution of marijuana is not concentrated. As long as recreational marijuana is against federal law, this will likely remain the case.

However, because of the short supply chains in Michigan, the supply chain for marijuana may mature faster than it has in Oregon, Colorado, and other states that legalized recreational marijuana before Michigan.

Indoor Grow Facilities vs. Outdoor Grow Facilities

While both indoor and outdoor growing operations are in place, it appears that production will shift primarily indoors over time. While outdoor grow facilities require less initial investment and lower production costs, greenhouses and indoor production have the advantages of…

- Producing higher yields.

- Year-round production.

- The potential to grow a more consistent product.

However, indoor marijuana growing facilities need access to sufficient electricity generation capacity. According to the findings, given the climatic and quality control factors, greenhouse/indoor production will most likely be the dominant technology used in Michigan.

Recreational Marijuana Prices

According to the study, prices in Michigan are expected to decline, maybe even faster than it did in Colorado because the, “national marijuana market has become more mature; entrepreneurs in the industry have learned from both their own mistakes and the mistakes of others.”

Supply Vs. Demand in Michigan

Initially, demand for marijuana and marijuana-based products will exceed Michigan’s production capacity, according to the study. Because of the United States’ regulation, which bans interstate transport of THC products, supply will likely be limited until Michigan’s industry adjusts and ramps up production to meet demand.

However, with a lag, it appears that marijuana production will eventually match the demand for marijuana.

Sales Tax Revenue

Based on projected sales, the Michigan Department of Treasury estimates that sales tax revenues from marijuana sales will be $97.5 million in 2020 and $143.0 million in 2021.

Since the Michigan marijuana tax is ad-valorem, or a tax whose amount is based on the value of a transaction or of property, actual tax revenues will fluctuate in proportion to the sale price and quantity sold at the retail level.

A major decline in the price of marijuana could reduce tax revenue. Additionally, if the percentage decline in the price is greater than the percentage increase in consumption, tax revenues will decline.

Effects of Federal Legalization on Michigan Tourism

The study anticipates that federal regulation will cause a decrease in tourism-based demand for Michigan marijuana. Therefore, the vast majority of recreational marijuana will be consumed by Michigan residents.

Does Marijuana Consumption Lower Alcohol Consumption and Sales?

According to the study, it appears that as marijuana consumption increases, alcohol consumption declines. It is common knowledge that some people substitute marijuana consumption for alcohol consumption. While legalized marijuana will raise revenues, there appears to be a somewhat offsetting reduction in alcohol consumption.

One report the study cited indicated that alcohol sales declined by 20 percent in counties where recreational marijuana is legal. However, this figure may be somewhat high, and alcohol sales seem to be declining with or without legal recreational marijuana.

What Does All of This Mean?

All in all, the marijuana industry in Michigan seems to be maturing rapidly as compared to other states. However, there are several factors that would be beneficial for its growth:

- Improved testing system,

- acceptance by local communities and municipalities, and

- supply to match demand.

Once these needs are met, Michigan is set to achieve the economic impact that the study anticipates.

Categories

Cannabis Legal Group Free Consultation

Get in Touch With Michigan's Most Trusted Cannabis Law Firm

We’ve Been Helping Michigan Marijuana Businesses Lay the Groundwork for Long-Term Security and Success for Years, and We Can Help You, Too.

Phone Number:

(248) 301-0626

© Cannabis Legal Group. All rights reserved.