A Major Problem for the Cannabis Industry: Lack of Traditional Banking

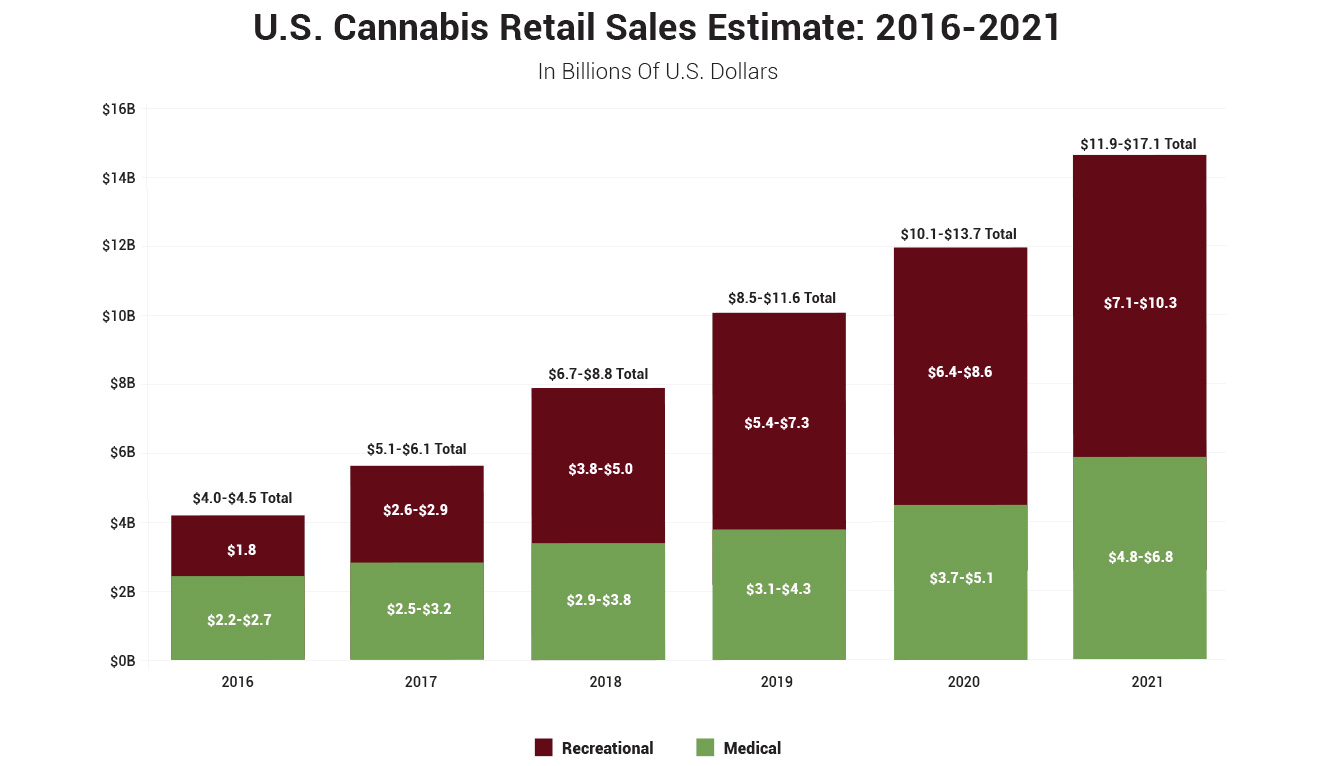

The biggest problem that currently faces the cannabis industry is the lack of traditional banking. This article examines the financial transaction considerations inherent in every regulated medical marijuana business in the country. Primarily due to the fact that cannabis is a schedule one controlled substance, lack of federal banking regulations and the financial institutions’ fear of money laundering, legitimate regulated marijuana-related businesses cannot avail themselves of traditional banking services. These services include financial institution deposit accounts, credit card processing, payroll processing, and check writing. In 2018 it is estimated that U.S. cannabis retail sales will be between $6.7-$8.8 billion dollars, almost all of which will be transacted without traditional banking services.

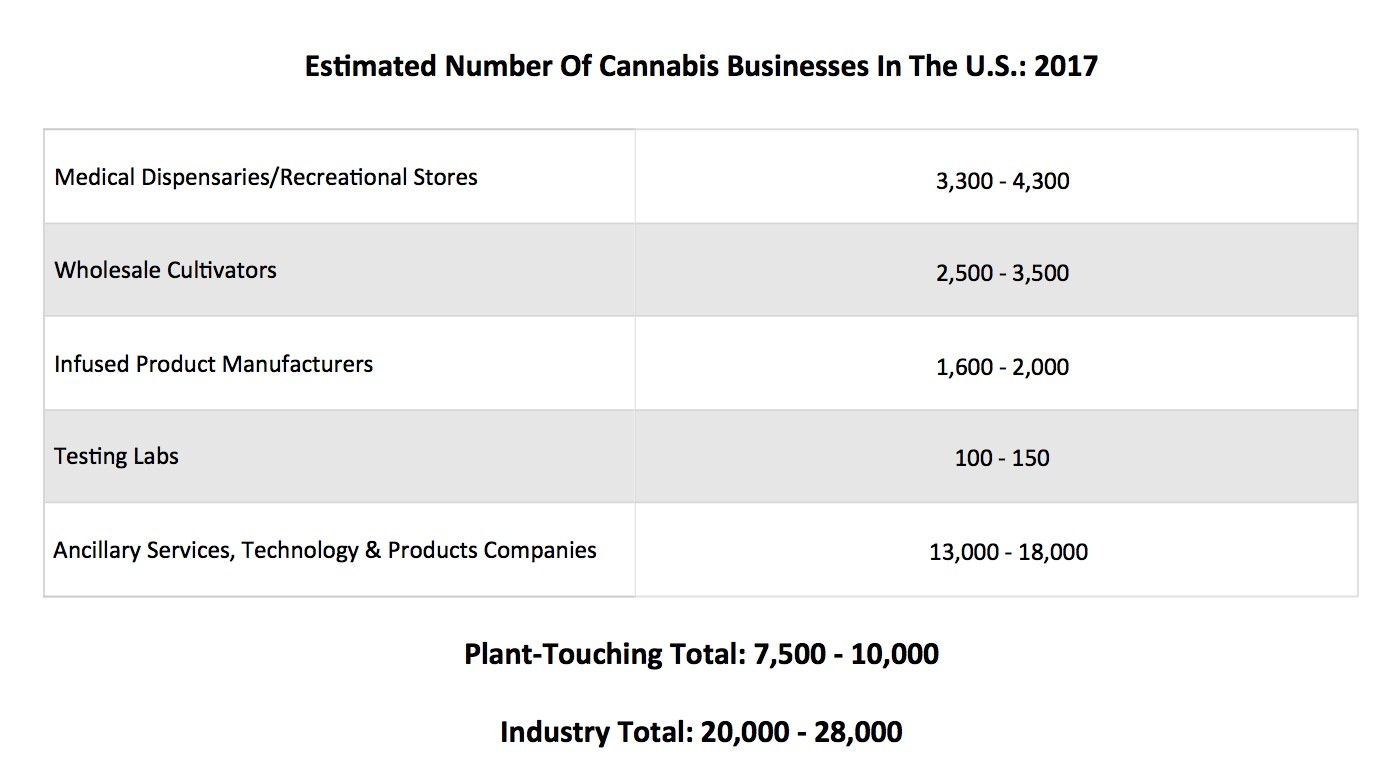

In 2017 there were an estimated 10,000 different cannabis businesses that could not utilize traditional banking services. Due to new state regulations in California and Michigan alone, that number will increase considerably in 2018. But, with these new very large regulatory markets, banking alternatives will be created but in small number.

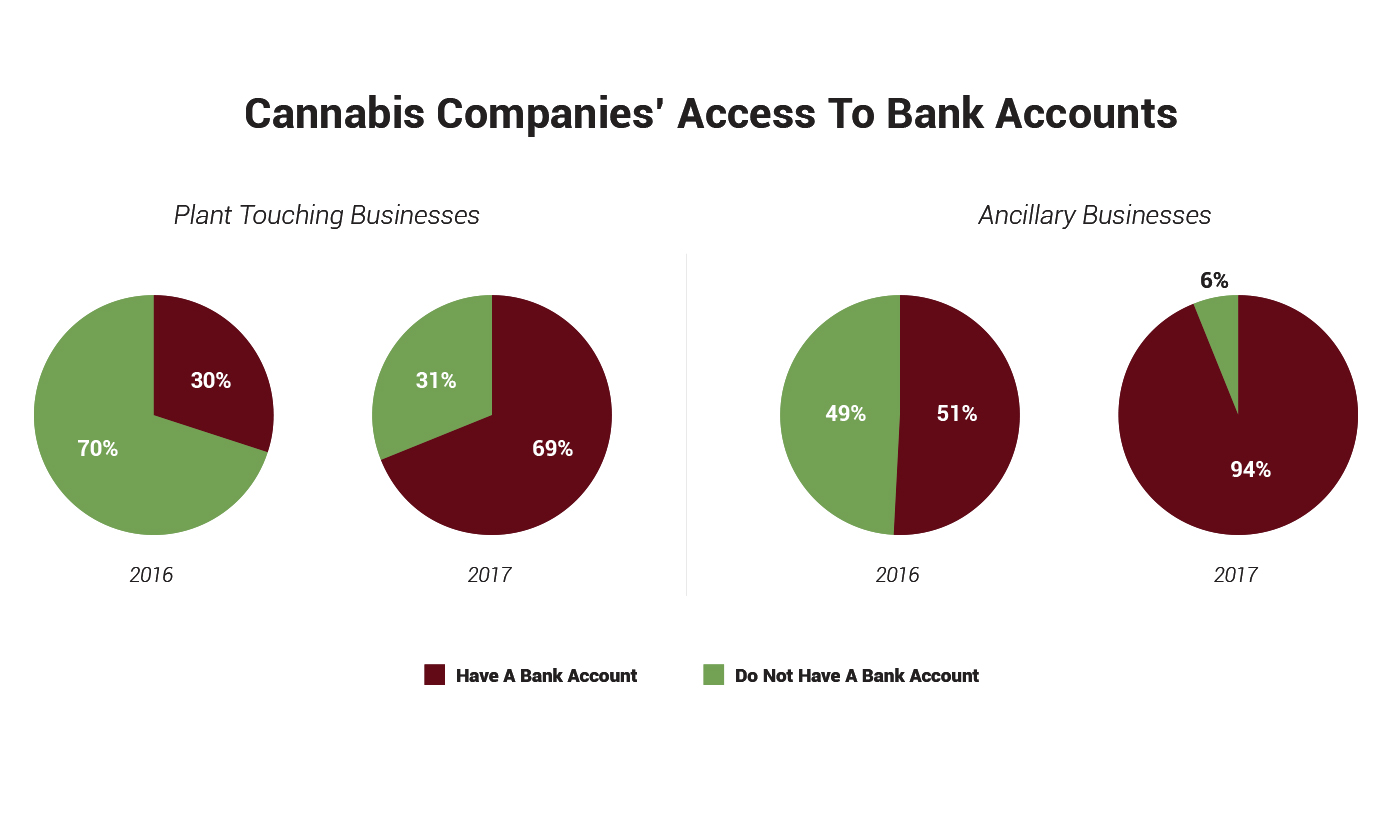

Due to strict seed to sale regulations, some banks have created compliance programs which ensure that all cash deposits are from legitimate sales. These banking relationships are costly, but they may be worth it. There are Michigan banks that are pursuing this opportunity but they will only take a limited number of accounts. It has been estimated that 30% of cannabis businesses have such an account. It is important that these businesses show a willingness to adapt to modern banking ways and they should also modernize in other ways too. This could include utilizing applications to improve their customer relationship management. So it could be useful to visit the salesforce website.

The rest of these businesses are forced to rely on 100% cash transactions and maintain strict cash management compliance standard operating procedures. Employees, vendors, and taxes (federal, state, employment, and income) are paid in cash. These cash transactions are completely legitimate, acceptable and a normal manner of doing business in the regulated, legal commercial cannabis marketplace. Cash will be transported by the same licensed secure transporters for marijuana.

In this cash business, cannabis specific CPA and bookkeeping services are extremely important. Compliance with Internal Revenue Code Regulation 280E is imperative. IRS audits on cannabis-related businesses are high. Nevertheless, as long as proper bookkeeping and tax preparation and payments are made, there is little to no chance of federal civil or criminal liability.

Updated Federal Banking Regulations

In the near future, it is expected that federal banking regulations on cannabis-based businesses will change. There were at least 38 pieces of favorable legislation regarding marijuana introduced in Congress in 2017. At least 8 of them called for federal banking reform including the Safe and Secure Banking Act of 2017 (SAFE) and the Compassionate Access, Research Expansion, and Respect States Act of 2017 (CARERS) both of which have received the most attention and will likely be re-introduced in the 2018 legislative session. A total of thirteen United States Senators have either sponsored or co-sponsored these bills with many others who support it. While none of them have yet made any significant progress, they demonstrate that this is increasingly an issue among several legislators including those in the Congressional Cannabis Caucus. Lack of traditional banking for the cannabis industry is one of the biggest problems that receive national attention. The National Cannabis Industry Association has a Federal Cannabis Policy Council which always provides significant support of banking reform legislation.

An Alternative to Cash

In a business that is blocked from traditional banking financing institutions for the reason that they are intertwined with the federal government, businesses may find alternative systems of exchanging currency. Cryptocurrency has become increasingly popular, not only in the cannabis industry but in the world. Bitcoin, Ethereum, and Single Point are the most popular. This is due to the wide-range of sites that now allow anyone with loads or little experience to buy bitcoin or buy ethereum.

They and other cryptocurrencies are built upon a centralized system called a blockchain. Each block contains the data from every financial transaction for the past 10 minutes. Powerful computers from all around the world, and the “miners” who run them work continually to validate each block. Once, validated, the block is attached to the chain which cannot be modified or hacked. The chain contains every transaction which is accessible to anyone. There are no middlemen, like banks, who charge a fee. The blockchain belongs to the people and not a government. Therefore, people can freely exchange value without governmental regulation which is precisely what forbids marijuana businesses from participating. There are multiple types of currencies and they can be used for practically anything. Some people use bitcoin with sites like bitcoin revolution so that they can trade their virtual currency and make a profit, and some, of course, use it to be marijuana.

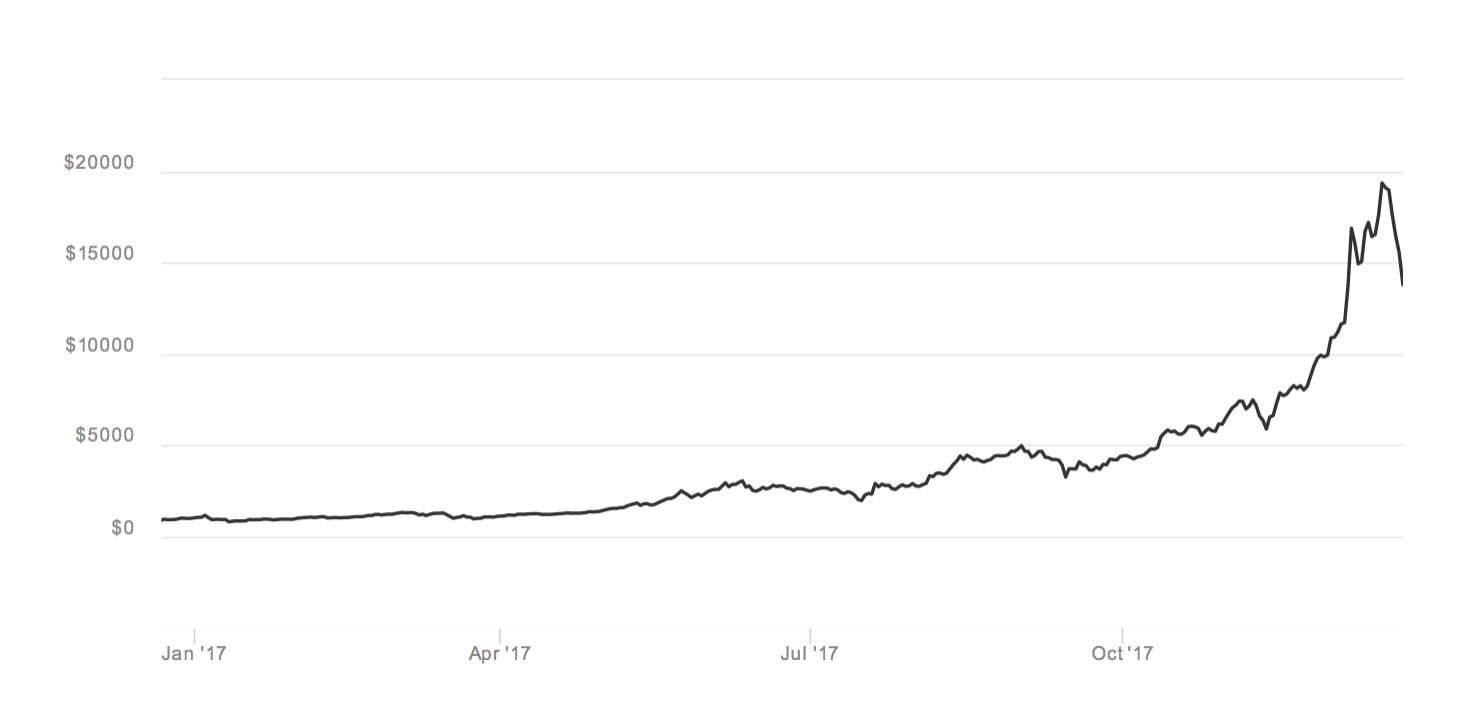

The value of bitcoin has skyrocketed in the past several months reaching almost $20,000 for one bitcoin. It was $1,000 at the start of the year. Bitcoin‘s success brought cryptocurrencies to the forefront and has also boosted the profile of its rivals, which offer alternatives to bitcoin.

Cryptocurrency transactions are publicly available and fully traceable which is an appealing trait to the marijuana industry and its regulators. Because every transaction is traceable on the blockchain, marijuana transactions between wholesalers, manufacturers, dispensaries, and consumers can be tracked to the satisfaction of government regulators. A company called SinglePoint has created an app in which consumers and dispensaries can exchange bitcoins for marijuana.

The biggest problem with cryptocurrency is the notorious volitive nature of its value. On December 17, 2017, the value of one bitcoin reached an all-time high of almost $20,000. Five days later the value plummeted by 35% to $12,616. For a currency, that is a large swing. Also, the IRS declares that cryptocurrency is actually property and not currency. That means any gain realized by holding them must be reported and subject to capital gains tax.

Despite these issues, the potential of this financial alternative is very significant. The cannabis industry could be a front-runner in adopting cryptocurrency as a safer alternative to cash.

Business Will Press On

In 2018, Michigan will begin to regulate the industry which will bring non-traditional banking opportunities to a limited number of cannabis businesses. Further, Congress will again attempt to reform banking policy. Until that happens, robust, diligent cannabis specific bookkeeping and CPA services, along with robust cash management standard operating procedures shall ensure that cannabis industry businesses in Michigan can be safely and profitably operated.

Categories

Cannabis Legal Group Free Consultation

Get in Touch With Michigan's Most Trusted Cannabis Law Firm

We’ve Been Helping Michigan Marijuana Businesses Lay the Groundwork for Long-Term Security and Success for Years, and We Can Help You, Too.

Phone Number:

(248) 301-0626

© Cannabis Legal Group. All rights reserved.