Annual Financial Statements Required by the MRA for FY 2019

UPDATE 3/20/2020: To all of our valued clients, we would like to update you on some very important matters affecting us all. Amid all the craziness and uncertainty surrounding your tax filing obligations, here is what we know now:

- The tax filing (and payment) due date for individuals and C corporations is now July 15th instead of April 15th, without penalty or interest. As of now, this is only at the federal level. However, most states, such as Michigan, follow federal due dates, so we expect the state to follow suit on this soon.

- Effective immediately, individuals (in Michigan) who have been laid off or had their place of employment closed dude to COVID-19 should reach out to see what options are available. To receive assistance, individuals are encourages to contact Treasury’s Collections Service Center at 517-636-5265 or by visiting their website here.

The Michigan Marijuana Regulatory Agency (MRA) recently issued a bulletin to announce the required annual financial statements for fiscal year 2019, pursuant to Section 701 of the Medical Marihuana Facilities Licensing Act (MMFLA). This much anticipated guidance outlines the financial reporting requirement for licensees.

Filing the Annual Financial Statements

Per the MRA bulletin, requirements for the annual financial statements are as follows:

- Only those medical marijuana facilities that were initially licensed as of August 1, 2018, must file the annual financial statement for fiscal year 2019.

- The annual financial statement must be filed with the Marijuana Regulatory Agency by December 31, 2019.

- The reporting period of the annual financial statement is August 1, 2018 through July 31, 2019.

- The annual financial statement must cover all licenses held by a licensee during the reporting period.

The licensee may submit a single annual financial statement for the licensee. Schedules required by the procedures must be submitted as follows:

- Procedures 1 and 2: Individual schedules must be submitted for each license held by the licensee for each procedure, except for licensees with stacked Class C licenses at a single location.

- Procedures 1 and 2: For licensees with stacked Class C licenses at a single location, conduct procedures 1 and 2 on the stacked licenses collectively. Individual schedules for each license are not required. For licensees with stacked Class C licenses at multiple locations, conduct procedures 1 and 2 on the stacked licenses at each location collectively and submit individual schedules for each stacked Class C location.

- Procedures 3 through 6: For all licensees, conduct procedures 3-6 for all licenses collectively. Separate schedules for each license are not required.

- Procedure 7: Individual schedules must be submitted for each provisioning center license held by the licensee.

Even though the reporting period is August 1, 2018 – July 31, 2019; the term “held” above is not to imply a reporting requirement for licenses issued during this reporting period. The reporting requirement is only if you were licensed by August 1, 2018. The annual financial statements are required to be filed with the MRA whether or not you had operating activity (i.e. sales). Further, all license’s owned by the entity, whether actively being utilized or not are required to be included in the annual financial statement.

CPA Performing the AUP Must be Independent

The annual financial statement must be an agreed-upon procedures (AUP) engagement conducted by an independent CPA licensed in this state and performed in accordance with the statements on standards for attestation engagements. The CPA must communicate its procedures and findings in an agreed-upon procedures report format as prescribed by the AICPA.

The annual financial statement must contain the required agreed-upon procedures and must be numbered as indicated.

- For each required procedure, indicate whether exceptions were noted and discuss all exceptions noted.

- Where the nature of the licensee’s records make conformance to the required procedures impractical or unreliable, the independent CPA may exercise professional judgment in modifying and performing the procedures as dictated by available records and in the manner most consistent with the objective to be accomplished, noting any differences between the required procedures and the procedures actually used.

The Certified Public Accountant (CPA) performing the AUP must be independent. The CPA that provides you bookkeeping, consulting and other accounting services cannot be the same person performing the AUP on your annual financial statements. Therefore, the independent CPA’s judgment cannot and must not be impaired. Further, the licensee’s records must be made available and sufficient enough to perform the AUP engagement.

Substantiating Sales and Cash Transactions

The following is an outline the agreed-upon procedures required for the Annual Financial Statement for fiscal year 2019, as further explained in the MRA advisory bulletin dated October 3, 2019.

Randomly select two (2) revenue sales transactions from the METRC system for each month of operation in the reporting period.

- Trace and compare revenue per METRC to underlying corroborating documentation.

- Trace and compare revenue per METRC to revenue recorded in the general ledger.

Provide a Schedule of Revenue for the transactions selected. The Schedule must, at a minimum, adequately document the transactions traced, reflect the documentation relied upon for corroboration, and reference the general ledger entries.

- Randomly select two (2) cash disbursements for each month of operation in the reporting period. Trace and compare the disbursement amounts and the period of service per the general ledger to underlying corroborating documentation.

Provide a Schedule of Expenses for the disbursements selected. The Schedule must, at a minimum, adequately document the disbursement traced, indicate to whom the disbursement was made, reflect the documentation relied upon for corroboration, and reference the general ledger entries.

The independent CPA must substantiate the sales and cash disbursements transactions. We are looking for accurate reporting and record-keeping. This will also aid in the verification of proper revenues and expenses being reported.

Verifying Wages and Employment

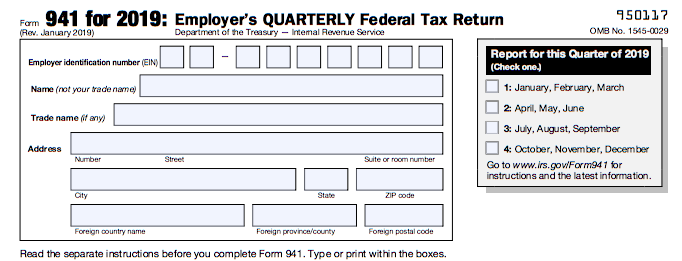

Obtain the quarterly Form 941 payroll tax reporting.

- Trace and compare total wages reported on Form 941 to payroll expense per the general ledger.

- Trace and compare the tax liability amounts reported on Form 941 to tax payments remitted to the federal government, and trace and compare the tax payments to bank statements or other evidence that payment was remitted.

Provide a Schedule of Payroll Tax. The Schedule must, at a minimum, include each calendar quarter date for which payroll taxes were due, the total wages paid for each quarter, the amount of tax liability for each quarter, a description of the type of corroboration used to document the taxes were paid for each quarter, and whether the payroll tax was remitted within 30 days after the end of the calendar quarter.

If the licensee has 100 employees or less, randomly select five (5) individuals on whom the licensee performed a background check who were subsequently chosen as employees or contractors. If the licensee has more than 100 employees, randomly select 5% of the individuals on whom the licensee performed a background check who were subsequently chosen as employees or contractors.

Inquire as to whether the individuals selected are considered by the company to be employees or contractors.

- For those that are employees, obtain and inspect the employees’ W-2 form and document their title.

- For those that are contractors, obtain and inspect the contractors’ Form 1099, document their title, date of engagement, date of termination of engagement, and hours worked for the company.

Provide a Schedule of Individuals for the individuals selected. The Schedule must, at a minimum, document the total number of persons for whom the licensee performed a background check who were subsequently retained as employees or contractors, the individuals selected, their title, the document reviewed and the tax year of the document.

COMMENTS: We are looking to verify that your employee’s and wages are being property reported. Required employment documentation will be used to verify lawful employment and compliance with the MRA’s employment requirements.

Identifying Equity Owners

Inquire of and obtain from management a listing of all equity owners of the licensee and their respective ownership.

- Identify and list all disbursements recorded through equity and compare the allocation of disbursements to the respective ownership interest of each equity owner of more than 10%.

- Identify and list all disbursements recorded through equity and compare the allocation of disbursements to the collective interests of equity owners of 10% or less. List the total number of equity owners, the date of each disbursement to those owners, and the total collective amount of each disbursement made to those owners.

Provide a Schedule of Ownership and Distributions. The Schedule must, at a minimum, include the name of each equity owner of more than 10%, the percentage interest owned, the date of each distribution, and the amount of each distribution. If the equity owner of more than 10% is a trust, the schedule must also trace the distributions from the trust to each beneficiary or payee allowed by the trust and include the date and amount of each distribution.

For disbursements made to equity owners of 10% or less, list the total number of equity owners for…

- each distribution,

- the date of each distribution, and the

- total collective amount of the distribution made to those owners.

Inquire of and obtain from management a listing of all licensing agreements that were effective at any time during the reporting period.

Looking to corroborate payments and distributions to owners of record and identify payments to individuals that are not owners. Anyone being paid a disproportion of profits will be flagged.

Tracing Licensing Agreements

In tracing the requirements for this procedure, all licensing agreements should be traced if there are no more than 5 licensing agreements effective at any time in the reporting period. If there are more than 5 licensing agreements effective at any time in the reporting period, randomly select 25% of the licensing agreements, but no less than 5 licensing agreements for each licensee.

- Trace and compare sales of the product(s) licensed under the licensing agreement per METRC to underlying corroboration.

- Trace and compare the licensing agreement payment terms with the amount paid to the licensor per the sales of the product identified in 6a.

- Trace and compare all payments made to the licensor during the reporting period to the findings of 6a and 6b.

Provide a Schedule of Licensing Agreements for the licensing agreements identified. The Schedule must, at a minimum, indicate the total number of licensing agreements that were effective at any time during the reporting period and for each licensing agreement selected, list the…

- name of the licensor,

- the date and title of the agreement,

- a description of the products subject to the agreement,

- the payment terms of the agreement (ex. $20 per piece),

- the number of products for which payment was made, and the

- total amount paid to the licensor during the reporting period

For provisioning centers only, obtain quarterly excise tax reporting for each calendar quarter for gross retail receipts from August 1, 2018 through March 6, 2019.

- Trace and compare the gross receipts reported per METRC for each quarter to the gross receipts reported to Michigan Department of Treasury (Treasury) for that respective quarter.

- Trace and compare the tax liability amounts reported to Treasury to the tax payments made to Treasury from tax receipts, bank statements, or other evidence that tax was remitted.

Provide a Schedule of Excise Tax. The Schedule must, at a minimum, include each calendar quarter date for which excise taxes were due, the gross retail receipts for each quarter, the amount of tax liability for each quarter, a description of the type of corroboration used to document the taxes were paid for each quarter, and whether the excise tax was remitted within 30 days after the end of the calendar quarter.

In Summary

The AUP of the financial statements will give the MRA, investors, licensee’s and the general public a certain level of independent assurance and integrity on the financial reporting of the licensee. Although, this engagement is not designed to test for or identify fraud, the CPA should however notify the client and the MRA if becoming aware of such instances under the normal course of the engagement.

This type of engagement will require a higher level of resources from the CPA firm. As such, plan ahead since you can expect this engagement to take at least 2-3 weeks for a “smaller” licensee to 6-8 weeks or longer for a “larger” multi-licensed operator. I’ve often communicated the extreme importance of having an impeccable accounting and bookkeeping system in place with the proper controls.

Unless otherwise changed by the MRA, the AUP of your annual financial statements will be a requirement that you need to plan for each and every year. Remember the MRA requires this engagement to be conduct on a fiscal year of August 1 – July 31, instead of a calendar year ending December 31.

We’re here to help and would be happy to arrange a consultation to discuss this and other topics further. Feel free to contact us at any time.

Categories

Cannabis Legal Group Free Consultation

Get in Touch With Michigan's Most Trusted Cannabis Law Firm

We’ve Been Helping Michigan Marijuana Businesses Lay the Groundwork for Long-Term Security and Success for Years, and We Can Help You, Too.

Phone Number:

(248) 301-0626

© Cannabis Legal Group. All rights reserved.