Cannabis Business Structure Guide

Choosing the best cannabis business structure for your cannabis business holds significant tax implications.

Before delving into the tax considerations, it’s important to understand that choosing an entity for tax purposes is different than selecting an entity for legal state organization purposes.

To be clear, you must choose a legal entity for state organization purposes and select another one for tax treatment purposes.

Below, we address the significant tax consequences to be considered by a cannabis operation in choosing the form of tax entity.

Need help determining and setting up the corporate structure for your cannabis business? Request a consultation now.

Corporate Cannabis Business Structure Types

Selecting a corporate structure and choosing a tax entity status is a unique challenge for cannabis sellers and growers.

Furthermore, there are typically three different types of business structures for cannabis businesses:

- C Corp

- LLC

- S Corp

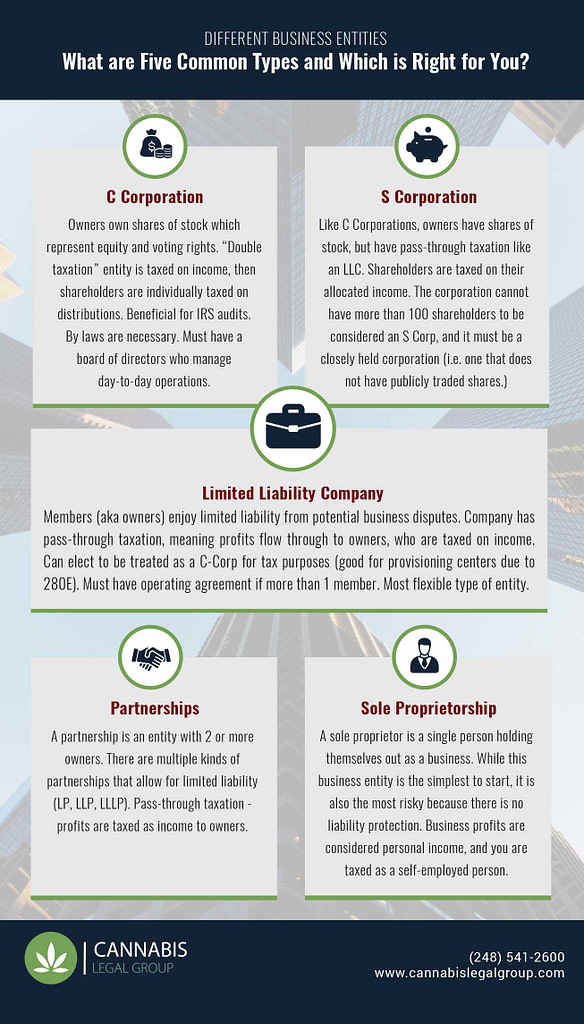

C Corporation

A “C-Corporation” refers to a standard, for-profit, state formed corporation.

It has a separate legal and tax life distinct from its shareholders.

However, a C Corp legal entity can’t elect flow-through entity tax treatment (i.e. can’t pass all its income to owners or investors of the business).

A corporation pays its own income tax on Internal Revenue Service (IRS) Form 1120.

Any profits are paid in the form of dividends and are taxed again to the recipient.

Dividend income at the individual shareholder’s tax rate results in double taxation.

However, most small corporations rarely pay dividends.

Larger cannabis businesses often choose C Corp legal status to benefit from a more structured operational environment that would otherwise be unwieldy due to the organization’s size.

Need help determining and setting up the corporate structure for your cannabis business? Request a consultation now.

S Corporation

An “S Corporation” starts as a C Corporation.

After its formation, an IRS Form 2553 is submitted and makes the S-Corp election.

This changes taxation to align with that of a partnership or sole proprietorship, rather than as a separate entity.

Therefore, income/loss generated by the S Corporation will “flow through” to an individual return.

The S-Corp must file IRS Form 1120S to report its annual income/loss to the IRS each year.

Limited Liability Company (LLC)

An LLC is a state-created, hybrid entity intended to provide its members/owner with the limited liability provided to corporate shareholders while minimizing many of the formalities required by corporate status.

The characteristic it shares with a partnership is “pass-through” taxation.

An LLC with only one member is taxed by the IRS as a sole proprietorship and files a Schedule C with their personal Form 1040.

A multi-member LLC is taxed like a partnership filing and informational Form 1065 (U.S. Partnership Return of Income).

Then, a Schedule K-1 is prepared for each member, showing their share of the gain/loss to be reported on their personal Form 1040.

Smaller cannabis businesses usually organize the legal entity as an LLC, taking advantage of the more flexible operational structure that is useful in smaller organizations.

Need help determining and setting up the corporate structure for your cannabis business? Request a consultation now.

What is the Taxable Net Income for Cannabis Businesses?

Currently, cannabis is illegal under federal law.

As such, federal income tax law, specifically IRC Sec 280E, prohibits cannabis businesses from deducting business expenses against gross revenue for federal income tax purposes.

That is a significant blow to the industry, since it creates an artificially higher taxable net income than actual book income.

However, the IRC 280E expense deduction prohibition doesn’t include barring deduction of Cost of Goods Sold (“COGS”) expense.

Cost of Goods Sold (“COGS”)

“COGS” includes all the costs and expenses directly related to the production of goods.

COGS generally excludes indirect expenses such as overhead, administrative, sales and marketing (“SG&A”).

However, calculating COGS for tax purposes is especially problematic for cannabis operations, due to a variety of factors such as:

- lack of guidance and clarity in the tax code,

- promulgated regulations, and

- tax court interpretations other than contained in Code Sec 471.

If cannabis were federally legal, taxable net income for cannabis businesses would be significantly lower.

Need help determining and setting up the corporate structure for your cannabis business? Request a consultation now.

The Risk of Tax Exposure for Cannabis Business Structures

Facilities/dispensaries are the most affected by IRC 280E, as compared to grow operations.

This is because retail operations have less opportunity for the allocation and inclusion of expenses (both direct and indirect) in its COGS calculation.

The industry is incentivized to allocate as much indirect expense as it can to COGS and deduct it to lower its taxable income.

Therefore, the tax exposure risk is significant.

C Corps can end up owing more taxes than actual earnings, and members/shareholders of LLCs and S Corps have personal tax liability exposure.

Furthermore, cannabis businesses should consult their accountants and other professionals on these matters.

Need help determining and setting up the corporate structure for your cannabis business? Request a consultation now.

What Corporate Cannabis Business Structure Should I Choose?

The Internal Revenue Service (IRS) has a public list of cannabis license holders.

They specifically target cannabis businesses for audit, since those audits are the most profitable to the IRS.

Due to unreliable COGS calculations and disregard of 280E, the IRS generally prevails in cannabis tax litigation.

Because of the heavy tax liability, retail operations often select C Corps for tax purposes.

Because of the IRC 280E expense deduction disallowance, taxable net income is higher than reported for flow-through entity LLC members and S Corp shareholders.

Additionally, flow-through entities could have a tax liability that exceeds actual profit.

Therefore, they can’t distribute cash to the owners to pay their taxes, for which the owners are personally liable.

Grow operations typically have less tax liability exposure, since they incur more COGS related expenses than retail operations.

The tax exposure for growth and processing operations lies mostly with poor record keeping discovered during an IRS audit.

Since grow operations have significantly less tax liability exposure, many elect flow-through tax treatment to avoid the ‘double taxation’ effect afforded by C Corps.

Need help determining and setting up the corporate structure for your cannabis business? Request a consultation now.

Both C-Corps and S-Corps are significantly more complicated than an LLC from a tax and legal standpoint and will require many more billable hours with your attorney or accountant. The LLC has become one of the most prevalent business forms in the United States due to simpler creation and less administrative paperwork while still affording liability protection to its members and avoiding double taxation.

Ultimately, the choice of a corporate structure and tax statuses is done on a case-by-case basis and tailors to each business with the consideration of their unique requirements. This decision is best made with experienced attorneys and/or tax professionals.

Categories

Cannabis Legal Group Free Consultation

Get in Touch With Michigan's Most Trusted Cannabis Law Firm

We’ve Been Helping Michigan Marijuana Businesses Lay the Groundwork for Long-Term Security and Success for Years, and We Can Help You, Too.

Phone Number:

(248) 301-0626

© Cannabis Legal Group. All rights reserved.